Why Exhibit

Growing Consumption and Understanding of Wine

Between 2021 and 2025, alcohol consumption in Singapore expected to increase by an average annual growth rate of 2.6%.

Younger consumers are more willing to explore new trends and flavours. Newfound knowledge and interest have shaped their preferences and made them more open.

Burgeoning Online Alcohol Market

Internet retail continues to be the fastest growing off-trade channel for alcohol. This trend is likely to persist with specialty online wine retailers appealing to an internet-savvy consumer base seeking convenience.

Growing Revenue and Spending Power on Alcoholic Drinks in Southeast Asia

Between 2023 and 2027, alcohol beverages revenue in Southeast Asia is expected to increase by an average annual growth rate of 10.31%.

Younger adults and middle-class consumers are more willing to explore new trends, new RTD (eg. Cocktails) and flavours. Newfound knowledge and interest have shaped their preferences and made them more open to purchasing unique alcohol.

No and Low Alcohol Market

In recent years, Southeast Asia has witnessed a significant surge in the demand for no and low-alcohol beverages. This shift in consumer preferences reflects a broader trend towards healthier and more mindful lifestyles.

According to IWSR, the global market for no and low-alcohol beverages, including beer, wine, spirits, and RTD products forecasted growth at a 7% CAGR from 2022 to 2026.

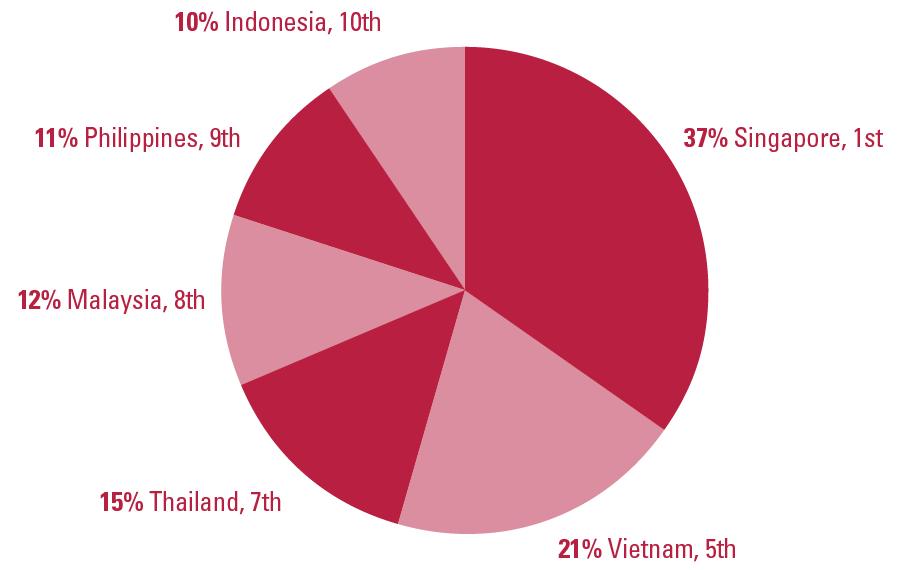

New Emerging Export Markets for Wine – Singapore Exhibits Highest Potential

Southeast Asia looks to be the blue ocean for the industry – with Singapore, Vietnam, Thailand, Malaysia, Philippines and Indonesia in the top 10.

(Source: IWSR, Statista, financial express, Vaishali Dar, Research and Market, foodnavigator)